Getting Started With GASB 87

By

If you’re part of a state and local government, university, healthcare network, or any organization subject to the GASB (Governmental Accounting Standards Board) rules, you’re probably aware of GASB 87, the new lease accounting standard that comes into effect later this year. And, while the delay in the deadline given by the GASB last spring has allowed you to focus on other things, it’s time now to start looking at the standard and how you will comply.

The standard has some complications, but with the right planning and approach, there’s still time to get things in order and make the deadline. So, here are a few of the basics you’ll need to start your compliance project.

When: The deadline to comply with the new standard is for fiscal years beginning after June 15, 2021. In our experience (and we were the leading provider of lease accounting solutions when public companies went through their compliance cycles starting in 2018), it usually takes longer than you’d expect to find, analyze and load your leases into whatever solution you’re using to comply (and before you ask… no a spreadsheet most likely will not cut it and here’s why). More often than not, even if your organization is fairly centralized, there are still hidden contracts or pockets of leases that are a surprise. So, give yourself time to hunt down all your lease contracts and get them under control.

What: Here’s the technical part. GASB 87 is based on the work done by the FASB (Financial Accounting Standards Board) and IASB (International Accounting Standards Board) in producing ASC 606 & IFRS 16. However, the GASB put its own spin on matters. In general, definitions are the same (what constitutes a lease, how to determine the term, lease vs. non-lease components, etc.), but GASB follows IASB in making all leases finance leases – GASB 87 does not allow for operating leases as does the FASB. As this article in the Journal of Accountancy states, “GASB 87 provides for three accounting treatments: short-term leases, contracts that transfer ownership, and contracts that do not transfer ownership — a catchall for all remaining leases of nonfinancial assets.”

Disclosures are somewhat different (including requiring future rents to be reported in 5-year tranches until final expiration). A good way to transition to the new standard is to restate lease accounting as of the first comparable year (i.e., the first year presented In your financial statements), but cutover on the transition date is permissible if restatement is “not practicable.”

What your peers are doing:

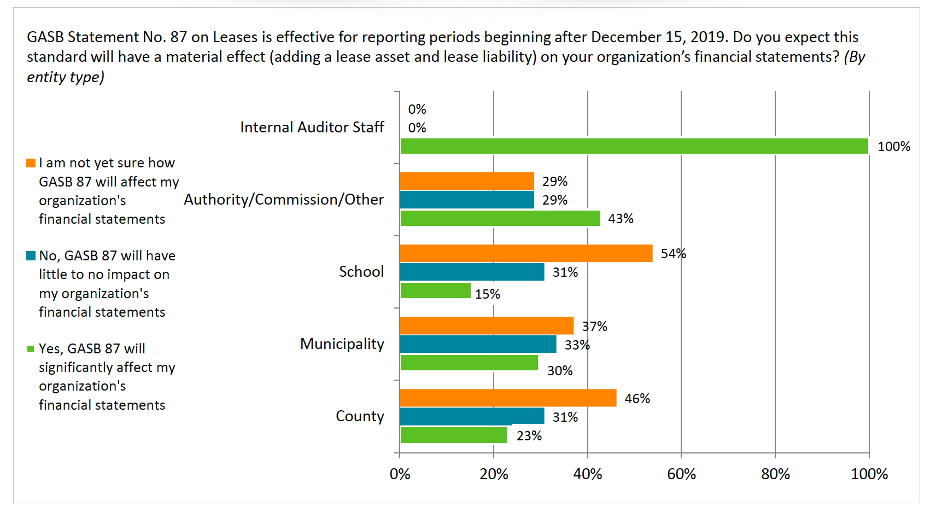

A study done in 2020 by Cherry Bekaert highlights just how local governments are looking at the impact of GASB 87 on their financial statements and shows where they are in the process of adopting the standard. Although most internal auditors think the standard will have a material effect on financial statements, few others have realized that yet. (Hint… the auditors probably have it right!)

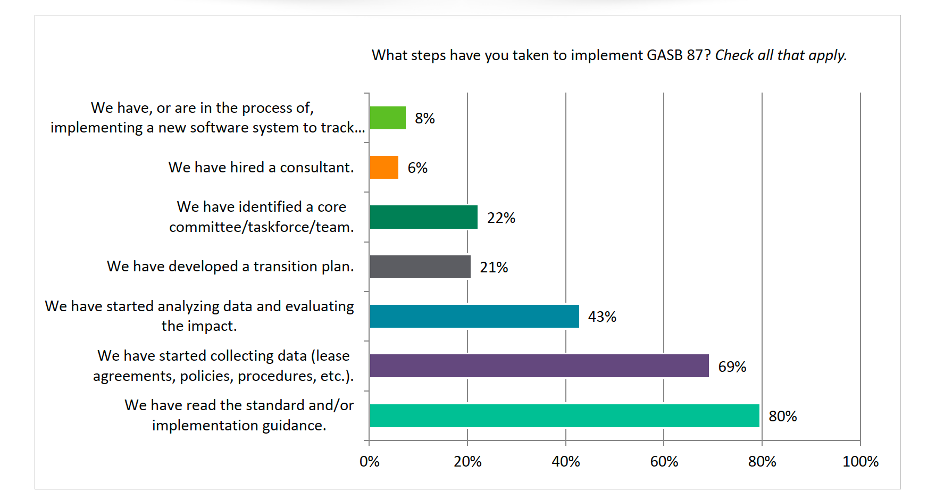

The survey also asked what steps organizations have taken to implement GASB 87, and most of the respondents have read the standard but only a few had implemented it using software. Given the delays that were announced, this isn’t too surprising, but a year on, it would be interesting to see where those same respondents are now. Still, it’s clear that those who have started gathering data won’t have any trouble meeting the deadline.

Where: Now that you’re thinking about compliance, where do you start looking for those leases? EZLease recommends that you take this two-pronged approach across people and books/records, to help you get complete data on your leases:

People: Who keeps the lease contracts? Depending on your organization, you may need to get cozy with the:

- Contracts department or the legal team

- Accounts payable or cash team

- Business unit head

- Procurement department

- Accounting team

- The administrative assistant team

PRO TIP – Many people think rent payments are not lease payments. We have heard, “Oh, we don’t have lease payments, we have rent payments”. There’s your sign that your colleagues aren’t familiar with the lease accounting definitions. Rent payments matter!

Books/records: Look for recurring payments in your cash disbursements journal, purchases journal and accounts payable subledger. Recurring payments may often be lease payments under the standard.

Challenges: One of the biggest challenges is keeping up with lease changes. As Len Neuhaus, CPA, VP of Lease Accounting at LeaseAccelerator states in this Accounting Today article, “A company with 300 leases will have to track an average of 230 events in a single year as assets come off lease, new leases are signed, and changes occur throughout the lease term. Real estate leases have frequent rent changes as well as expansion clauses, tenant improvement allowances, and early renewal options that can be executed at various points in a 10-year lease.”

He also notes, “Equipment assets under lease can be lost, stolen, damaged, purchased, returned, renewed or upgraded during the relatively short term of a three-year lease. Tracking these activities manually with spreadsheets and emails proves challenging to the most organized accountants.” So, look closely at your lease portfolio to make sure you understand how your leases will behave so that you can pick the right solution to manage them.

If you are also a lessor, you have more to consider. Many GASB lessors are also GASB lessees for the same property. Take for example a municipality that leases a building from an unrelated third-party (lessee accounting) and then subleases a portion of that building to another party (lessor accounting). These common scenarios need to be reflected properly in the accounting, given that the length of term used might be different for the lessee component versus the lessor component, discount rates might be different, and the disclosure requirements are much more robust than ever before.

How: Take a little time to lay out a project plan and figure out what resources you have to work on GASB 87 compliance. Check out a lessor and/or lessee accounting example to walk through how the accounting works or turn to other online and consulting resources to get started. If you only have a few leases, you can do this without outside help. But, if you have a large portfolio of leases, or if you’re a lessee and a lessor, or if you are tight on internal resources, you might want to consider working with an advisor or consultant (and note that, unlike EZLease, not all lease accounting solutions handle lessor compliance). Working with a partner who has expertise in GASB 87 projects can make the process go more smoothly.

Next steps: Start gathering your leases and figuring out how you’ll manage the ongoing compliance requirements across your team. Before you start to do this on spreadsheets, remember that your spreadsheets can’t check for accounting errors or provide the audit trail you’ll need. Look for software that makes it easy to upload and modify leases on your own and that helps you close your books faster with all the right disclosures. You’ve got this!

Download the GASB 87 Lease Accounting Standard Handbook to learn more or get started with the EZLease free trial.

Additional resources:

- The Governmental Accounting Standards Board has released Implementation Guide 2019-3, Leases, to assist government users with the new governmental lease accounting standard, GASB Statement No. 87. Pages 1-20 of the document are in the form of 77 questions and answers about various issues in lease accounting, for both lessees and lessors. Appendix B, pages 25-30, includes illustrative examples, though these are qualified as “nonauthoritative.” The examples aren’t overly complex but lay out fairly typical leasing scenarios