ASC 842 Summary

Understanding the ASC 842 lease accounting standard

Everything you need to know in one place

ASC 842 Overview

The lease accounting standards were established to prevent the financial statement fraud of companies like Enron and WorldCom, while addressing the lack of debt transparency in reporting. In 2019, the latest Financial Accounting Standards Board (FASB) standard on lease accounting, ASC 842 (ASU 2018-11), went into effect for most public companies. Private companies and universities were granted a later adoption date, which has now been extended to years beginning after December 15, 2021, and interim periods within fiscal years beginning after December 15, 2022. At this point, all public and private entities are required to comply with ASC 842.

What is ASC 842?

When is the ASC 842 deadline?

Our clients got compliant in hours.

Under 6 leases?

What's new under the ASC 842 standard

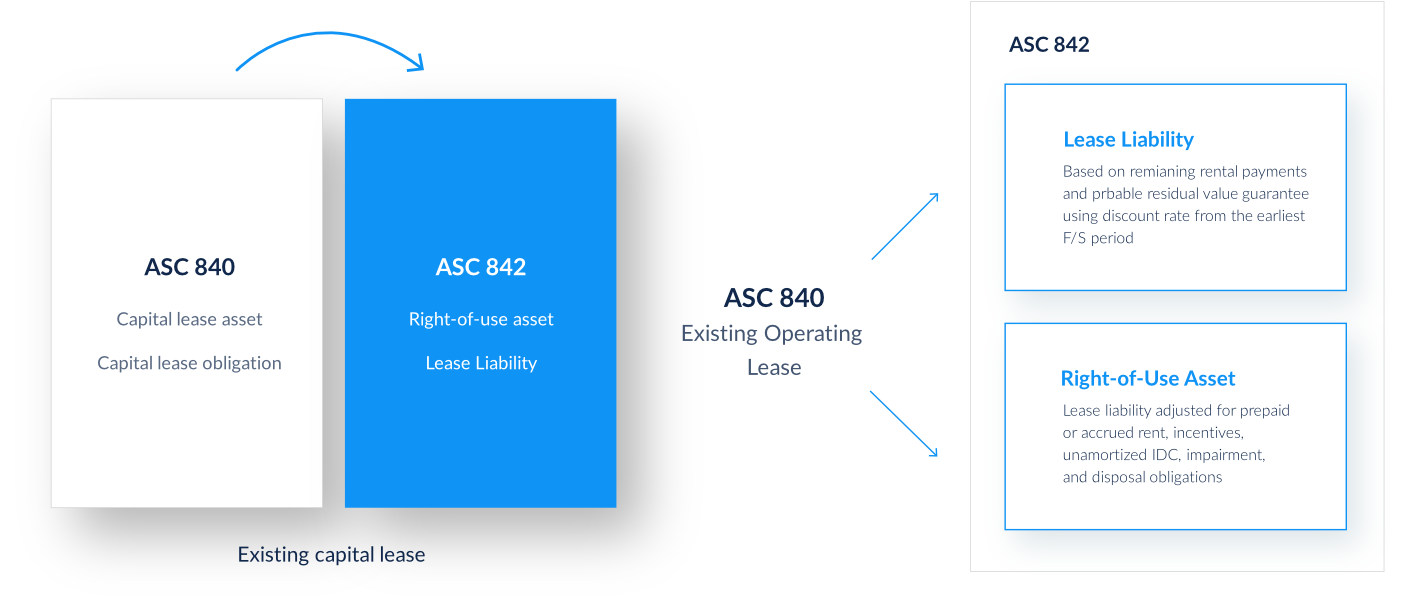

- The biggest change is the capitalization of operating leases, which occurs under both FASB’s ASC 842 and the International Accounting Standard Board’s (IASB) IFRS 16. However, there are a few differences between ASC 842 and IFRS 16 – first, they split on how to classify leases to be capitalized on the balance sheet. The FASB created a dual classification model of operating and finance leases, while the IASB determined that all on-balance-sheet leases will be accounted for as finance leases.

- Under finance lease accounting, an asset and a liability are recorded at the present value of the lease payments on the balance sheet, with certain modifications for items such as prepayments and initial direct costs. On the income statement, the lease costs are recorded as a straight-line amortization expense plus a declining interest expense.

- Organizations will need to use either the interest rate from the lease or the practical expedient of the Incremental Borrowing Rate (IBR) to calculate present value.

- Under the FASB’s operating lease accounting standard, operating leases are capitalized similarly to finance leases (previously called capital leases under ASC 840). However, the profit and loss (P&L) expense remains as a straight-line average expense.

- The FASB and the IASB allow a short-term lease (12 months or less) exemption from lease capitalization. The IASB allows an exemption from capitalization for leases less than or equal to US$5,000 in value.

ASC 842 lease accounting examples

Classifying leases with ASC 842

Handbook

ASC 842 guide

History

What is the difference between ASC 840 and ASC 842?

Building the current lease accounting standards

The history of these lease accounting standards goes back even further. For a complete guide to ASC 842, read the timeline below. For an IFRS 16 timeline, click here.

Timeline: the history of lease accounting

(ASC 842)

-

The Committee on Accounting Procedure determined that operating lease accounting shouldn’t be used for long term leases. They issued the bulletin, Disclosure of Long-Term Leases in Financial Statements of Lessors, which required finance leases to be recorded as a leased asset and long-term liability. However, since capitalization was not required by GAAP, most lessees still used off-balance lease reporting.

-

The Accounting Principles Board issued Reporting of Leases in Financial Statements of Lessees which established that leases should be categorized as finance if the contract has a nominal purchase option.

-

The Accounting Principles Board issued Accounting for Leases in Financial Statements of Lessors which issued different criteria for finance lease identification than the 1964 opinion.

-

The SEC asked the FASB to create comprehensive lease accounting rules. They issued FAS 13, Accounting for Leases. This standard has been in place since 1976, though it has been amended multiple times since then.

-

The Group of Four Plus One (G4 + 1) which includes Australia, Canada, New Zealand, the United Kingdom, and the United States plus the IASB published a discussion paper for a converged standard for lessees which called for the elimination of operating leases.

-

G4 + 1 began work on a converged standard for lessors building on the 1996 discussion paper.

-

The Enron Scandal took place causing the SEC to investigate accounting practices that could allow corporate fraud. At this point, the SEC discovered the off-balance sheet operating lease loophole.

-

FASB began work on a new lease accounting standard intended to close the loophole of off-balance operating leases.

-

The FASB and IASB issued a Discussion Paper proposing that lessees capitalize all leases on the balance sheet.

-

The FASB and IASB issued an Exposure Draft and distributed it for public comments. The model set forth in the ED proposed that lessees move all leases onto the balance sheet as a right-of-use asset and liability. Lessees, lessors, and the accounting community in general reacted negatively to the ED because they felt the proposal was overly complex and lacked consistency.

-

After multiple discussions, meetings, and revisions, The FASB and IASB issued a Revised Exposure Draft, and opened a four month comment period. After, the boards solidified parts of the standard, including that all leases would be brought onto the balance sheet (except short-term leases), expense recognition models, and liability measurement.

-

The FASB published ASC-842, the new lease accounting standard for companies report- ing under US GAAP. The IASB issued IFRS 16 (eIFRS login required), the new lease ac- counting standard for companies reporting under the International Financial Reporting Standards.

-

The FASB issued an update to ASC 842 to both clarify and simplify the application of the new lease standard to land easements. The FASB also issued a proposal to ease companies’ transition to the new standard by offering a practical expedient that would allow companies to apply the transition provisions at the adoption date, instead of at the earliest comparative period. The proposal was approved in July of 2018. Also in July, the FASB issued codification improvements affecting narrow aspects of the standard.

-

The FASB issued codification improvements to ASC 842 in March that covered fair value, statements of cash flows, and transition disclosures.

-

Due to COVID-19 market disruptions, the FASB modified compliance deadlines for private and select not-for-profit organizations, pushing them out by one year. The earliest deadline is for those whose year-end is December 31 – they will need to transition to the standard by January 1, 2022.

1949

1964

1966

1976

1996

2000

2001

2006

2009

2010

2013

2016

2018

2019

2020

ASC 842 handbook

Learn about how to adopt the standard and ways to make your implementation successful.

ASC 842 operating lease example

Use this short tutorial to see how to account for an operating lease.

ASC 842 capital/finance lease example

Use this short tutorial to see how to account for a finance lease.

ASC 842 TRAC lease example

Use this short tutorial to see how to account for a finance lease.

onDemand Webinar: Locating leases

Get best practices for loading and managing leases for FASB and GASB compliance.

onDemand Webinar: What your auditor wants you to see

Get tips for a successful audit to make the process easier.