IFRS 16 Overview

Understanding

the IFRS 16 lease accounting standard

Everything you need to know about IFRS 16

IFRS 16 overview

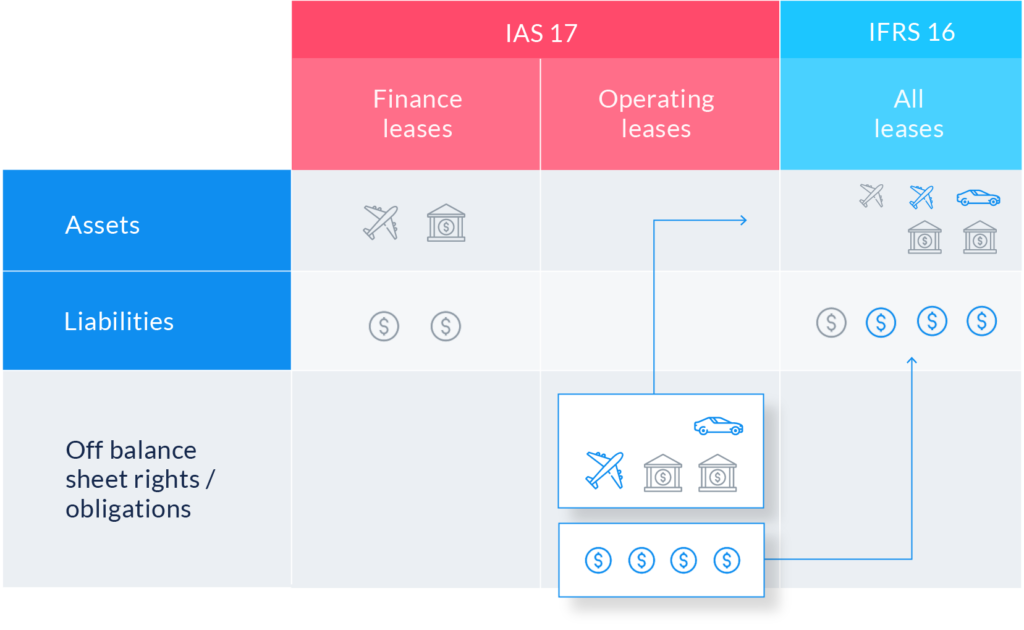

The financial statement fraud in Enron, WorldCom and others were drivers to the creation of the new IFRS lease accounting standard. IFRS 16 closed the loophole which allowed corporations to hide certain assets and liabilities off-balance sheet. Under the standard, companies are required to capitalize most leases on the balance sheet — reporting them as right-of-use assets and lease liabilities. As a result of the shift, capitalized lease obligations face increased auditor scrutiny, pushing companies to focus on ensuring accuracy and completeness of what they report as well as leading to greater transparency and comparability of financial statements.

Keeping operating leases off the balance sheet is believed to obscure the true nature of a company’s liabilities from potential investors. To increase transparency into corporations’ true lease liabilities, the International Accounting Standards Board (IASB) developed a new standard that eliminated the operating lease classification.

What is IFRS 16?

In 2019, the latest IASB lease accounting standard, IFRS 16, began to go into effect for companies worldwide. Among other requirements, IFRS 16 required that most leases be capitalized and recorded on the balance sheet, changed how they’re reported, and eliminated most operating (non-capitalized) leases. According to the American Institute of Certified Public Accountants (AICPA), approximately 90 countries have now adopted IFRS. Aligned closely to IFRS 16, there are many country-specific versions, including AASB 16 in Australia, NZ IFRS 16 in New Zealand, FRS 116 in Singapore, HKFRS 16 in Hong Kong, and K-IFRS 16 in South Korea.

Handbook

Lease accounting under

IFRS 16

This is a brief introduction to IFRS 16. For more detail on the technical accounting as well as how companies can successfully achieve and maintain compliance with the standard, download our full IFRS 16 Handbook.

When is the IFRS 16 deadline?

IFRS 16 replaced IAS 17 with an effective date starting on 1 January 2019. Most global businesses have already adopted IFRS 16 and are now considering ways to optimize those implementations. The latest Global Lease Accounting Survey highlights some of those opportunities.

What’s new in IFRS 16

The most notable change is the elimination of the operating lease classification. Under IFRS 16, all leases, excluding those that meet the practical expedient for low-value and short-term leases, if elected, are treated as finance leases. The lease assets and liabilities are recognized on the balance sheet, which may result in a significant increase in the amount of assets and liabilities many companies report. Finance leases are also reported differently on the profit and loss (P&L) statement than operating leases under the previous standard. Operating leases were reported as a straight-lined rent expense. However, under IFRS 16, all lease expenses are reported as a separate (usually straight-lined) amortization expense of the asset and a declining interest expense based on the liability being reduced with periodic payments. As a result of the standard, the lease expense will likely impact financial metrics such as EBITDA, as amortization and interest are excluded from the EBITDA calculation while the lease expense is included.

The IASB also considers leases to be debt, and as such, debt to equity ratios may see a dramatic increase. This could impact debt covenants not covered by frozen GAAP contractual provisions as well as credit ratings, if the lease liability recognition resulting from the adoption of IFRS 16 is significantly different from analysts’ expectations. The ROU Asset is an intangible asset where the liability is tangible, and accordingly may affect asset ratios as well. Lastly, remeasurements of the lease liability are required due to changes in variable rents, such as those based on an index or rate.

IFRS 16 lease accounting standard summary

- All leases are recognized (except where the entity has elected to use the short-term and low-value exemptions) at the present value (PV) on the balance sheet.

- All leases have a P&L pattern that is frontloaded (where rent expense is replaced by a usually straight-lined amortization of the asset and declining interest expense).

- Variable rents based on a rate (e.g., SOFR) or an index (e.g., CPI) are recognized based on spot rates. The value of the lease liability, with a corresponding adjustment to the lease asset, must be remeasured when the rate or index adjusts.

- Short-term (less than or equal to 12 months at lease inception) and low-value leases (less than or equal to US $5,000 even if material in the aggregate) can continue to be accounted for off-balance sheet if so elected.

Accounting examples

We’ve built a set of lease accounting examples to help you get started. Use our free IFRS 16 lease accounting examples below to understand how the standard works or see the ASC 842 journal entries in real-time in our free trial.

IFRS 16 additional implications to consider

Businesses need to consider other implications that this standard has triggered, such as:

- The definition of a “lease”. IFRS 16 states “an entity shall assess whether the contract is, or contains, a lease” – consequently, what is included as a lease is not always straight forward.

- Leases need to be adequately evaluated (particularly complex leases) to ensure the correct accounting outcome is achieved;

- There may be additional tax burdens, such as deferred tax;

- Ongoing compliance may require additional resources and (suitable) systems to manage the process.

History of IFRS 16

After the accounting scandals of the early 2000s, there was a major push by the accounting standards boards to close accounting loopholes and increase transparency into the true financial position of corporations.

One of the loopholes identified was the operating lease loophole under IAS 17 which allowed companies to report operating leases in the notes of financial disclosures. To close that loophole and increase transparency, the IASB released IFRS 16 in January of 2016.

IAS 17 Leases (1997) is the previous lease accounting standard for all companies that report under international financial reporting standards. IAS 17 used a dual-model classification approach. One classification, finance leases, was capitalized on the balance sheet as an asset and liability and reported on the P&L statement as an interest and depreciation expense. The other classification, operating leases, was reported in the notes of financial statements.

Timeline: The History of Lease Accounting (IFRS 16)

-

IAS 17 Accounting for Leases (1982) was issued with an effective date of 1 January 1984.

-

The Group of Four Plus One (G4 + 1) which includes Australia, Canada, New Zealand, the United Kingdom, and the United States plus the IASB published a discussion paper for a converged standard for lessees which called for the elimination of operating leases.

-

IAS 17 Leases (1997) was issued with an effective date of 1 January 1999. This superseded the previous IAS 17 Accounting for Leases, of 1984. Under IAS 17, leases had to be classified as either operating leases or finance leases. Operating leases were reported as an expense on the income statement and in the notes of financial disclosures. Finance leases had to be reported as an asset and liability on the balance sheet.

-

G4 + 1 began work on a converged standard for lessors building on the 1996 discussion paper.

-

The IASB began work on a new lease accounting standard intended to close the loophole of off-balance operating leases.

-

The IASB released a Discussion Paper covering preliminary views on the creation of a new lease accounting standard and invited comments. The discussion paper proposed moving all leases onto the balance sheet to be capitalized as an asset and liability.

-

The IASB released the first Exposure Draft for the new lease accounting standard and invited comments. The draft established the model to report all leases on the balance sheet as an asset and liability. In general, this model was met with criticism.

-

The IASB released the second Exposure Draft after multiple discussions with stakeholders and several revisions. This model solidified parts of the new standard, including the model to bring all leases, except short-term leases, onto the balance sheet.

-

The IASB released IFRS 16 (eIFRS login required) in January of 2016 with an effective date of 1 January 2019.

Accounting example: ASC 840/IAS 17 operating lease example

Use this short tutorial to see how to account for an operating lease.

eBook: IFRS 16 Handbook

Learn about how to adopt the standard and make your implementation successful.

On-demand webinar: Maximising the return on your IFRS 16 investment

Optimise long-term compliance with the right approach.

Fact sheet: Why spreadsheets won’t work – an ANZ perspective

If you’re still using spreadsheets, for lease accounting, it’s time to change.

Accounting example: ASC 840/IAS 17 capital lease example

Use this short tutorial to see how to account for a capital lease.

Accounting example: ASC 842/IFRS 16 finance lease example

Use this short tutorial to see how to account for a finance lease.

Accounting example: IFRS 16 TRAC lease example

Use this short tutorial to see how to account for a finance lease.

IFRS 16 FAQ

IFRS 16 requires lessees to recognize most leases on their balance sheets as right-of-use assets and lease liabilities, resulting in a significant increase in assets and liabilities. Lease payments are recognized as interest expense and amortization of the right-of-use asset, which front loads the recognition of lease expenses in the income statement. The extent of the impact on a company’s financial statements will depend on the size and nature of its lease portfolio.

IFRS 16 was effective for annual reporting periods beginning on or after January 1, 2019. This means that companies applying IFRS were required to adopt the standard as of January 1, 2019, and report the impact of the new standard in their financial statements for the reporting period in which it was first applied. However, companies were allowed to apply the standard retrospectively or using a modified retrospective approach.

IFRS 16 applies to all types of leases, including property leases, requiring lessees to recognize them on their balance sheet as right-of-use assets and lease liabilities. This includes property leases for office space or manufacturing facilities. Exceptions related to short-term leases and low-value assets apply, but otherwise, all leases are subject to IFRS 16 requirements.

Under IFRS 16, there is no distinction between operating and finance leases for lessees. Most leases are recognized on the lessee’s balance sheet as right-of-use assets and lease liabilities. A less may elect to exclude low value leases (leases of assets with a value of USD 5000 or less when they are new) and short-term leases (with a lease term of 12 months or less), from the scope of IFRS 16. However, the classification of leases as operating or finance leases is still relevant for lessors.